Award-winning PDF software

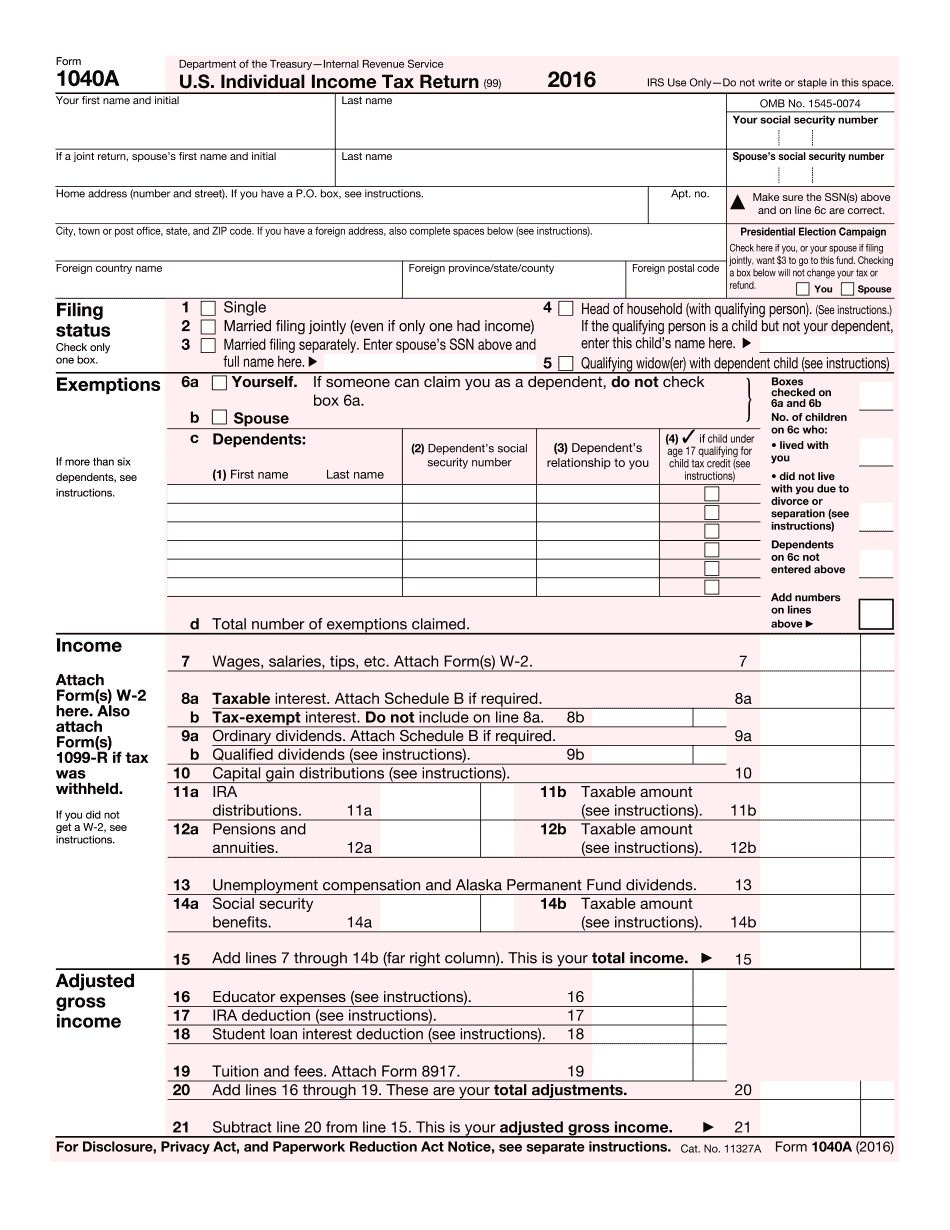

North Las Vegas Nevada 2025 IRS 1040-A: What You Should Know

Texas Tax Law — Revised 2025 (for 2019, 2020, and 2021) Texas Revenue and Taxation Code Article 6.01 Taxpayers who fail to file a required return in Texas before the due date may be subject to a fine, up to 500, or both, according to the state of Texas Revenue and Taxation Code. Note that Texas law does not penalize taxpayers for late returns if that late return is correct. Texas Tax Law — Revised 2025 (for 2019, 2025 and 2021) Texas Revenue and Taxation Code Article 6.02 A. Taxpayers who fail to file a required return or penalty assessed under this chapter shall be assessed a penalty of not more than 100 for each return that is not filed or with respect to which there is no late filing penalty assessed. B. Notice of an assessed penalty and failure to pay the penalty within six months after the service of said notice shall be sent by first-class mail to the taxpayer and to the taxpayer's attorney. The notice shall advise the taxpayer of the right to contest the assessment and of the statutory limitations period applicable to the contested case. C. For the purpose of determining any such penalty, a taxpayer is presumed to have been notified of such penalty for any period that begins during the one-year period prior to the time notice is mailed. D. A penalty shall be imposed regardless of whether the penalty remains unpaid after 90 days from the date of the final mailing or on the anniversary of the day on which the original return was filed. E. A penalty assessed pursuant to this chapter shall not be reduced by amounts paid with respect to the same return to any governmental agency. F. Any penalty assessed shall be refundable in a manner specified by the Texas Department of Revenue and Taxation Code, unless the taxpayer, following administrative remedies, demonstrates to the Texas Tax Commission that: 1. a deficiency exists as a result of the late filing; 2. the amount assessed by the Tax Commission is excessive; 3. the taxpayer has requested a refund of any refundable tax imposed under this chapter; 4. no refundable tax was imposed by another taxing authority; 5. the period for tax return correction has been exceeded; 6.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete North Las Vegas Nevada 2025 1040-A, keep away from glitches and furnish it inside a timely method:

How to complete a North Las Vegas Nevada 2025 1040-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your North Las Vegas Nevada 2025 1040-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your North Las Vegas Nevada 2025 1040-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.