Award-winning PDF software

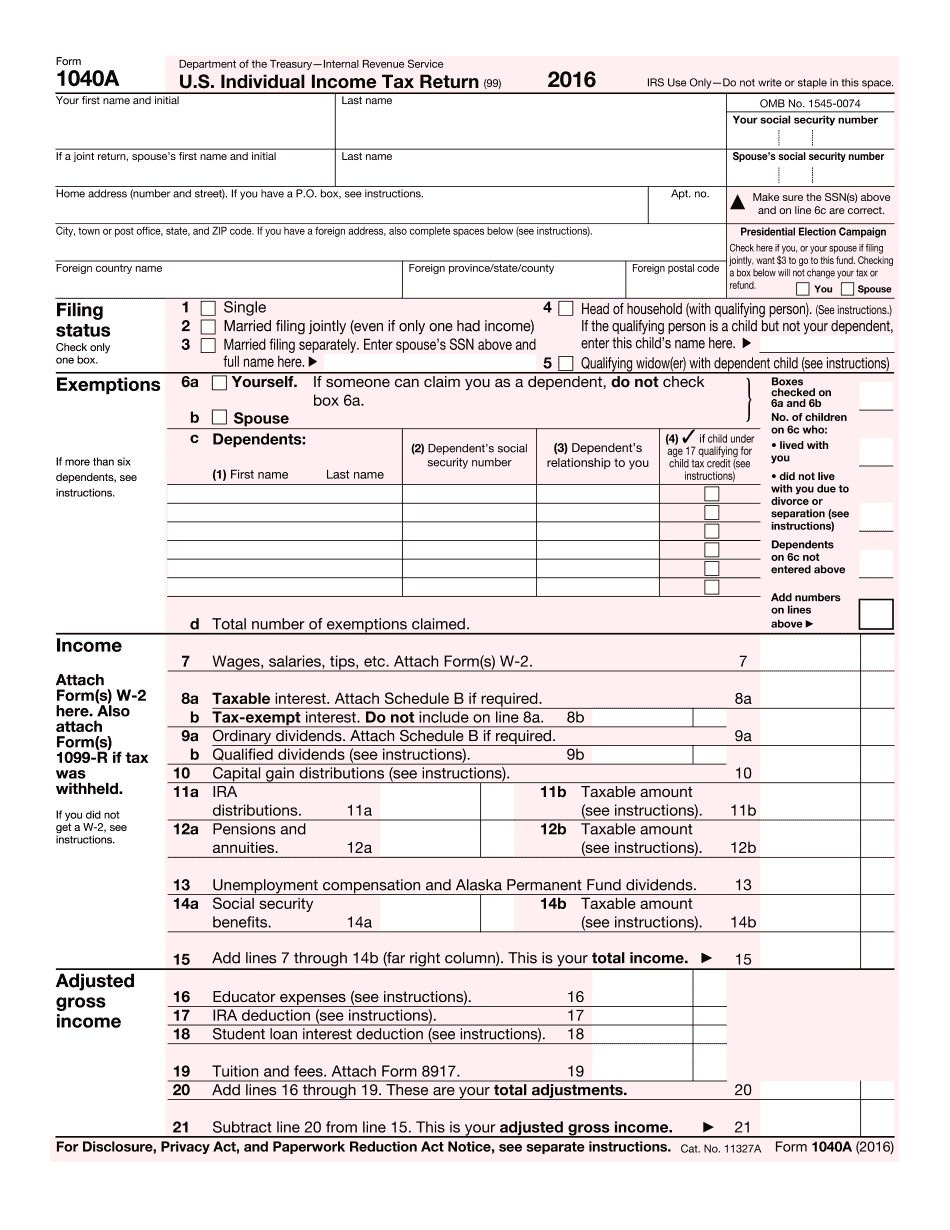

2022 IRS 1040-A Arlington Texas: What You Should Know

The IRS announced Friday that it would grant a tax break to storm victims as well as other disaster victims. “All states and tax jurisdictions are entitled to apply for and receive tax relief and assistance through the Disaster Tax Relief and Recovery Act of 1970,” the Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2012, which extended the period during which tax refunds could be extended during the recent severe winter storms. “The Disaster Tax Relief and Recovery Act was designed to provide relief, relief, and relief to American taxpayers. That's why we're looking for the most vulnerable in our communities who need our help most and the most economic devastation. We're committed to providing tax relief by supporting those impacted by last winter's severe winter storms, as we continue to work through our recovery. “We encourage communities to consider providing financial relief to their residents with questions regarding the Disaster Tax Relief Act,” said IRS Commissioner Douglas Schulman. The IRS will waive the penalty for nonpayment of uncollected installment agreements in instances of 1040 filing failure by individuals who claim the relief under Section 6012 or the section 6029. This means that taxpayers can choose to receive[e] the hardship allowance for tax period and that the taxpayers are eligible to receive the relief tax credit. The waiver also applies to any state, county, municipality, school district or similar entity. Under Section 6002, any person or entity whose gross income attributable to certain qualified disaster areas is in excess of 5,000,000 for the period of disaster can be issued a hardship relief allowance for tax period. The hardship allowance will reduce the taxpayer's tax liability and is used to recover from a tax deficiency, to reimburse personal expenses, to improve or replace equipment or to improve or replace property that may be damaged or destroyed by or to which a disaster has occurred and not previously taken measures to limit its damage. The disaster tax relief program allows taxpayers who have suffered damage as a result of disaster to recover from tax liability through a hardship allowance for the tax year. These individuals have incurred expenses as a result of the disaster and have not been reimbursed by insurance, reimbursement from insurance, or private sources.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1040-A Arlington Texas, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1040-A Arlington Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1040-A Arlington Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1040-A Arlington Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.