Award-winning PDF software

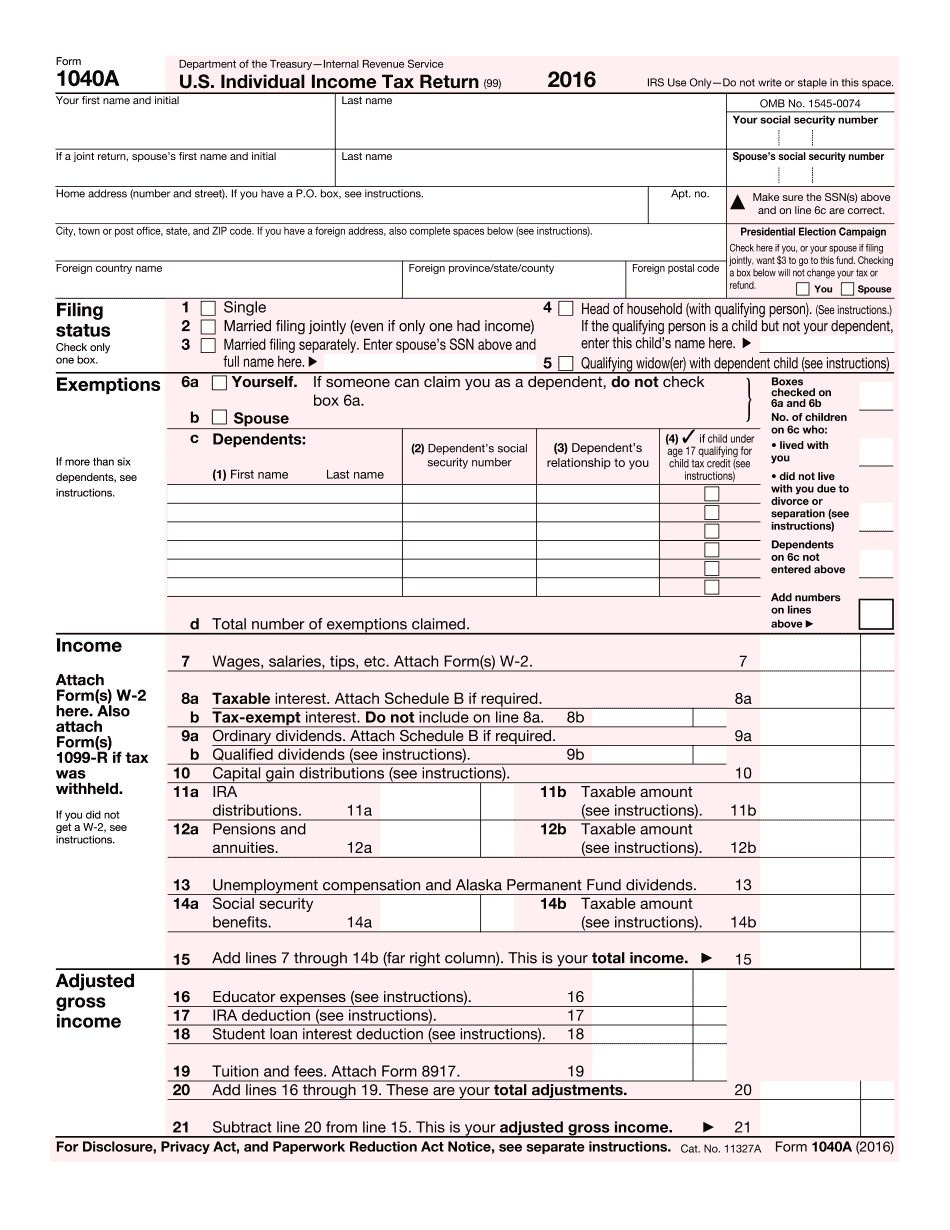

Toledo Ohio 2025 IRS 1040-A: What You Should Know

January 1, 2025 — City of Toledo. City of Toledo Expenses — City of Toledo City services for City taxpayers are available to ensure prompt service by the City and assist residents to comply with the legal obligations under the City Code, City budget and property taxes. These services include, but are not limited to, the following: Paying property taxes; Hiring or contracting for the services of tax preparers; Permitting City employees to perform clerical services in connection with the collection and payments of delinquent taxes; Preparing or filing tax returns; Permitting City employees to accept deposits or payments from taxpayers for the services of tax preparers; and Providing City residents with information about how their City services are administered, which may include providing information about the various City programs and services that are available or a list of telephone numbers for those services. City of Toledo Property Taxes — Toledo City Government Property Tax Office If the City of Toledo pays property taxes on your property, taxes will be paid through the Toledo City Property Tax Office's Automated Filer/Payment System. The City Property Tax Office charges no additional fees for processing returns through this system. Note that for homeowners with City taxes: Individual Homeowners Pay Online You can pay City of Toledo taxes online now through our City Pay system. Simply go to the City Pay website where you can input your address, and the appropriate information must be entered on each item. This includes your first and last name, address, tax bracket and your tax account number. Note: Tax returns for owners with multiple property owners will be processed by one person. For a detailed description of the City's automated payment system, please see our City Tax Guide which has been reviewed and approved by Mayor Duchesses and is available under “Publications and Special Projects” in the City's main lobby. For information on the City of Toledo's property tax bill, please refer to our Annual Tax Burden Map for our entire city.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Toledo Ohio 2025 1040-A, keep away from glitches and furnish it inside a timely method:

How to complete a Toledo Ohio 2025 1040-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Toledo Ohio 2025 1040-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Toledo Ohio 2025 1040-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.