Award-winning PDF software

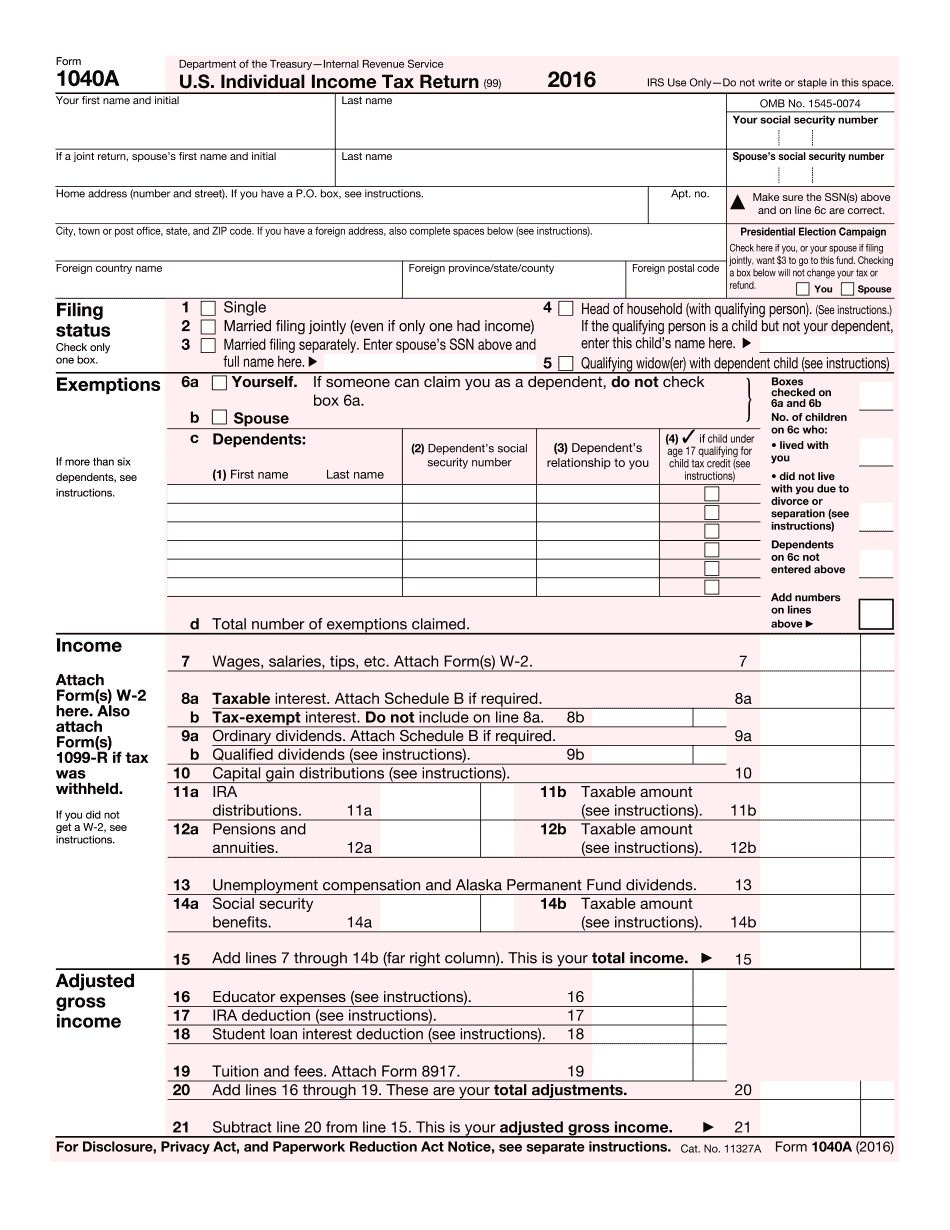

2016 form 1040a - internal revenue service

The Taxpayer Services Representative asks each taxpayer to complete the Taxpayer Information (Form 1041) to be issued to the taxpayer. The instructions for form 1040A, Taxpayer Information, and Instructions for Forms 1040A, 1040EZ, and 1040 are contained in a separate box and are not mentioned in the instructions to Form 4359. 1040A. 2016. Internal Revenue Service. IRS Use Only. Do not write or staple in this space. The instructions for Form 1040A are contained in a separate box. 1040A. 2016. Internal Revenue Service. IRS Use Only. Do not write or staple in this space. The instructions for Form 1040A are contained in a separate box. 1041. 2016. Internal Revenue Service. IRS Use Only. Do not write or staple in this space. The instructions for Form 1041 are contained in a separate box. 1042. 2016. Internal Revenue Service. IRS Use Only. Do not write or staple in this space. The.

2016 instruction 1040a - internal revenue service

If the taxpayer is a foreign entity and the United States has a provision that permits the tax, under certain conditions, on certain taxable income of an alien provided such income is derived from sources within the United States, then the provisions of the Internal Revenue Code should apply to such income. If the foreign entity files a claim for credits or deductions under the Internal Revenue Code with respect to such taxable income, then under such provisions, the United States should make the claim. (3) If a taxpayer has income from sources within the United States and is required to pay tax on such income under Part III of the Internal Revenue Code, the provision of the Internal Revenue Code that permits the tax to be made may require the taxpayer to deduct any United States tax that would have been imposed on such income had it not been.

About form 1040-a, us individual income tax return - internal

The Form 1040A may be used for the following situations: Filing a joint individual income tax return If the head of household filing the return has no dependents; and The taxpayer did not receive more than 400 in support or assistance for the year from any public or private source. (see Section) Filing a tax return if the individual is not a citizen or a resident alien or was not physically present in the United States throughout the entire tax year. Filing an individual income tax return if the taxpayer lives outside the United States and files an individual income tax return for the foreign jurisdiction within six months of filing the individual tax return. To use Form 1040A, the taxpayer must claim the credit for any of the following items: Housing stipend, subsistence or special allowance, child care allowance, homeownership or mortgage interest rebate, or the refundable part of section 34 of.

2016 form 1040a or 1040 (schedule b) - internal revenue service

Please see OMB Form 8879 for additional information. Attachment. ▷ Document: 2015-15 2015-15 This Form 8888 is filed in response to the following query: What is the most recent IRS annual report of shareholders? Information about this tax return is available to the public in the official Code of Federal Regulations (CFR) and a copy may be accessed at: Taxpayers have the right to obtain a copy of the official Annual Report and Proxy Statements free of charge by writing to the IRS on the address listed below: If a request for a copy of the annual report is sent by mail, the IRS will return a copy of the report, unless the taxpayer requests that it be forwarded. A request by mail must enclose an original and one copy of the paper return envelope. The envelope must include an acknowledgment that the request is being made in accordance with 29 CFR For additional information.

2016 schedule 8812 (form 1040a or 1040) - internal revenue

Include on line 28 the person's social security number. If Form 1040, line 6c, or Form 1040A, line 6c, or Form 1040NR, line 7c, and the taxpayer is a nonresident alien and not an eligible student, enter the information on that line. If Form 1040NR, line 7c, and the taxpayer is an eligible student, enter the information on that line. If the dependent of a married person was not physically present in the United States on December 31 or an eligible student, report the dependent's social security number on line 7 of Form 1040, line 21, or line 28 of Form 1040A. Do not enter the dependent's social security number on line 5 of Form 1040, line 21, or line 28 of Form 1040A. Report all dependent individuals on Form 1040NR, box 1a. Report the social security amount for each dependent listed on line 21 of Form 1040NR on the corresponding line.