Award-winning PDF software

Printable 2025 IRS 1040-A Rhode Island: What You Should Know

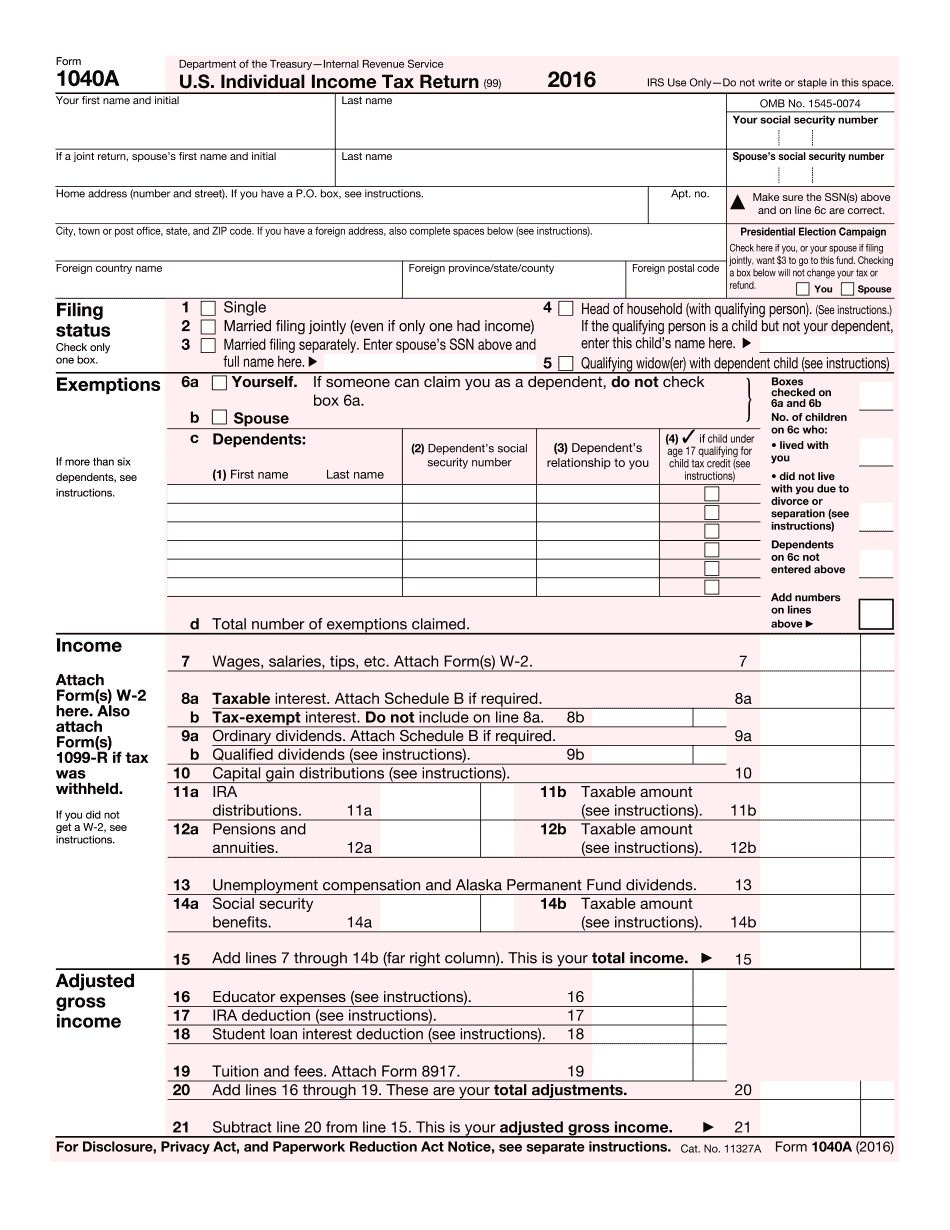

Mar 14, 2025 — Use Form 1040-ES, or make your own (see instructions in form). Form 1040. 2023. Annual Individual Income Tax Returns. Department of the Treasury—Internal Revenue Service. (99). OMB No. .8.8.10.1 (2). 30. Do you have additional tax questions or need additional information? If you don't find answer to some of your question on the list below, please post it to the RI.gov discussion forum. If you have more questions about state income taxes, or to find the information you need on the Taxpayer's Resource Center, please consult with an experienced tax professional. 30.10. Are There Any Additional Tax Consequences for Married, or Common-Law Couples? No. 30.11. Where Can I Find More Information About the Federal Income Tax? Income Tax Facts for Individuals (IRS) provides detailed information about individual income taxes (see Part I, Schedule A) and the alternative minimum tax (see the instructions under Part II of Form 1040). Also, see the IRS link below. The IRS also issues Income Tax Statistics for Individuals (TI GTA) for specific years. TI GTA also provides information on the tax implications of retirement plan contributions, and it provides other reports as part of IRS's National Program of Statistical Assessment and Research (SPEAR), a program whose mission includes the collection and analysis of information from various parts of the United States and other countries. Income Tax Statistics for Individuals (TI GTA) Report of the Tax Institute of the Department of the Treasury on the Economic Effects of Tax Reform. Published March 2010. Income Tax Statistics for Individuals (TI GTA) Report of the Tax Institute of the Department of the Treasury on the Economic Effects of a Low Income Tax and its Consequences for Taxpayers. Published July 2009. The following publications are also useful: Citizens' Guide to the Alternative Minimum Tax—PDF — See page 6 of this PDF file. Tax Planning 101: Alternative Minimum Tax (AMT) and the Alternative Minimum Tax (AMT) Special Rule—PDF — See pages 3-4 of this PDF file. Tax Planning 101: Alternative Minimum Tax (AMT) and the Tax on Capital Gains—PDF — See page 14 of this PDF file.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable 2025 1040-A Rhode Island, keep away from glitches and furnish it inside a timely method:

How to complete a Printable 2025 1040-A Rhode Island?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable 2025 1040-A Rhode Island aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable 2025 1040-A Rhode Island from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.