Award-winning PDF software

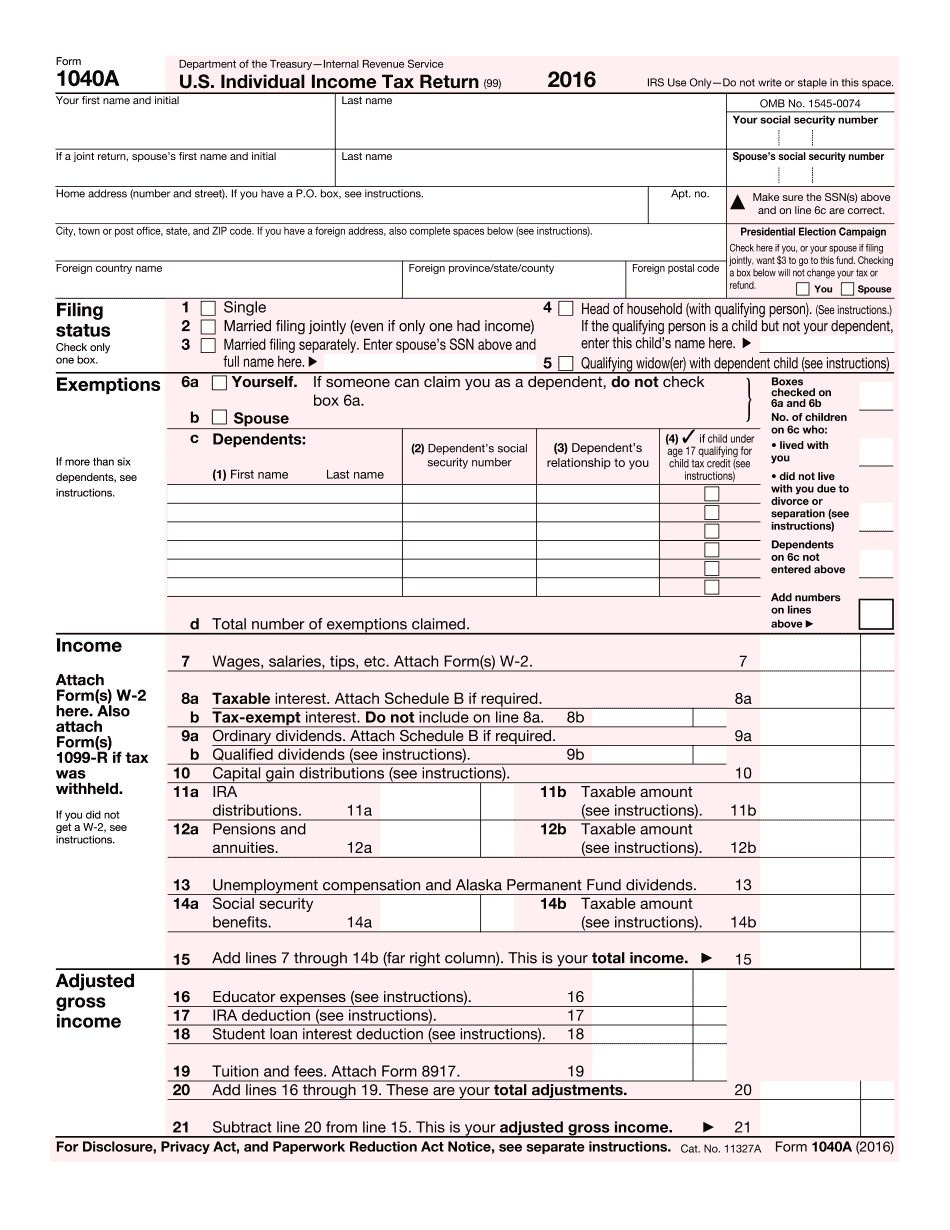

MI 2025 IRS 1040-A: What You Should Know

If you don't see any local addresses, go online to access Michigan State Tax Return (MRT) Locator. You can select 'Find a post office box (PO Box) closest to that address' and click the button to search for a post office box near your address. Aug 16, 2025 — Follow IRS guidelines for using the 'Filing Status Notify' (FS) mail feature to notify taxpayers and tax professionals of tax information requests filed electronically by the IRS during Calendar Year 2022. Aug 10, 2025 — Check the IRS Filing Status Notify (FS) feature for a notification of IRS requests to see your taxpayer information and other tax-related information in the FNS. Use FNS mail feature when sending an IRS request to see your taxpayer information and other IRS-requested information. Aug 1, 2025 — Find IRS mailing addresses for taxpayers from outside the United States filing returns to Michigan during the 2025 taxable year and also send taxpayers and tax professionals instructions for filing returns electronically in Michigan using FNS Mail feature. For more information, go to IRS Websites and IRS Directives. Tax Information for California Residents Taxes and filing requirements for residents of California are subject to various tax laws, regulations, and administrative rulings. This publication is not a substitute for the state tax law or other applicable tax guidance. California tax laws and regulations and the California Administrative Code may be found online at California Department of Tax and Fee Collection. The Code and its implementing regulations are subject to change without notice. You should refer to the official publication designated in this publication for California specific tax information. California Sales Tax The state of California imposes a tax on the purchase price of personal property. The tax is 6.25% of the price. Business License Tax California imposes a tax on the total value of all payments made by a California entity to a nonresident for the performance of services rendered. The tax is 2.5% of the total payment. The total purchase price of personal property in California is assessed at the county or city level, and may be taxed at a rate of tax determined by the municipality. The amount assessed for personal property may also be adjusted as needed to reflect sales, use, services or other factors. The county or city may impose an additional tax of .50% of the total purchase price for each year of the nonresident's ownership period. This nonresident purchase tax rate may be reduced, suspended or eliminated in limited circumstances in accordance with specific county or city laws.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete MI 2025 1040-A, keep away from glitches and furnish it inside a timely method:

How to complete a MI 2025 1040-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your MI 2025 1040-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your MI 2025 1040-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.