Award-winning PDF software

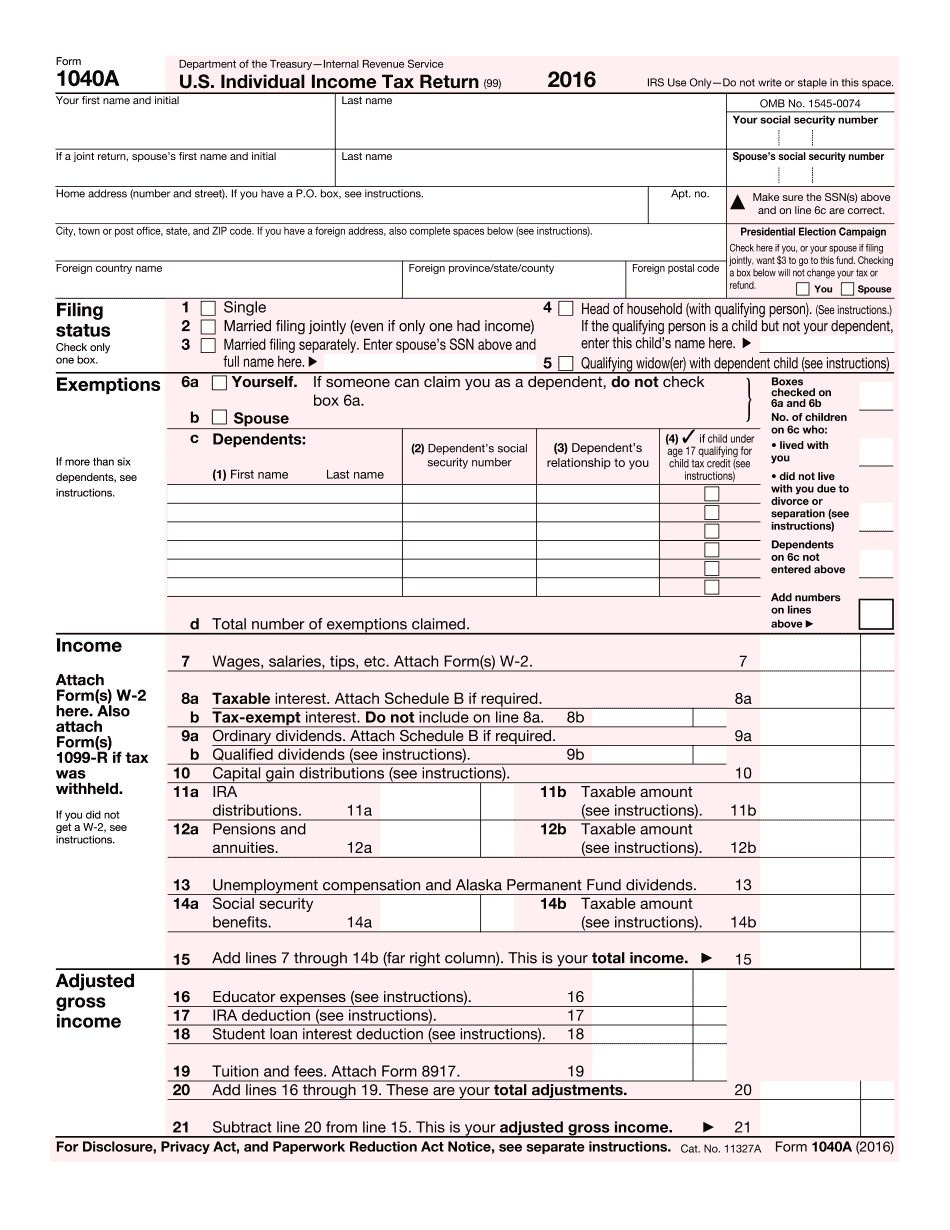

Kings New York online 2025 IRS 1040-A: What You Should Know

See Publication 509, Tax Calendars, for other dates in 2018, 2025 and 2020. New York — Where to File Addresses for Taxpayers and Tax The IRS has opened a line to accept tax-related questions and comments. The line is answered within 2 business days, 7 days a week. You can also make voice and text submissions in English or Spanish. Oct 15, 2025 — WASHINGTON — Victims of Hurricane Ida in New York now have until December 5, 2021, to file various individual and business taxes in New York. Sept 27, 2025 — LOS ANGELES — In compliance with the requirements of a September 2025 IRS Taxpayer Advocate Form 2455, the Internal Revenue Service is issuing a notice to state and local tax administrators and taxing jurisdictions warning about potential tax withholding deficiencies. The notice reminds taxpayers that any nonfilers will be subject to a penalty (including interest) of the greatest of 50% of the unpaid liability, or 100, and to a forfeiture of interest on all tax due, up to 11,900, as a result of the tax rule to withhold 100% of self-employment taxes. Additional Information How do you file a tax return or claim an exemption from a tax? You can file a tax return by either e-file (using IRS software to electronically file your return and e-file any attachments) or by mail. If you are a United States taxpayer, you should electronically file Form 1040X (PDF). You can also file Form 1040 (PDF) electronically. For tax returns filed on paper, you will probably file Form 1040NR (PDF) or Form 1040NRF (PDF) by mail, or you may use a tax professional to file it for you. For more information, go to How to File a Tax Return (PDF). What is an electronic filing? A paper-based return is filed electronically when the IRS receives it in a timely manner. Paper-based returns are deposited with the U.S. Treasury. Are there any special filing requirements for this filing deadline? Because the Federal government shutdown began on October 1, all requests for extensions of time to file personal tax returns are now being denied by the IRS. Taxpayers who have filed their personal tax returns before a U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Kings New York online 2025 1040-A, keep away from glitches and furnish it inside a timely method:

How to complete a Kings New York online 2025 1040-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Kings New York online 2025 1040-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Kings New York online 2025 1040-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.