Award-winning PDF software

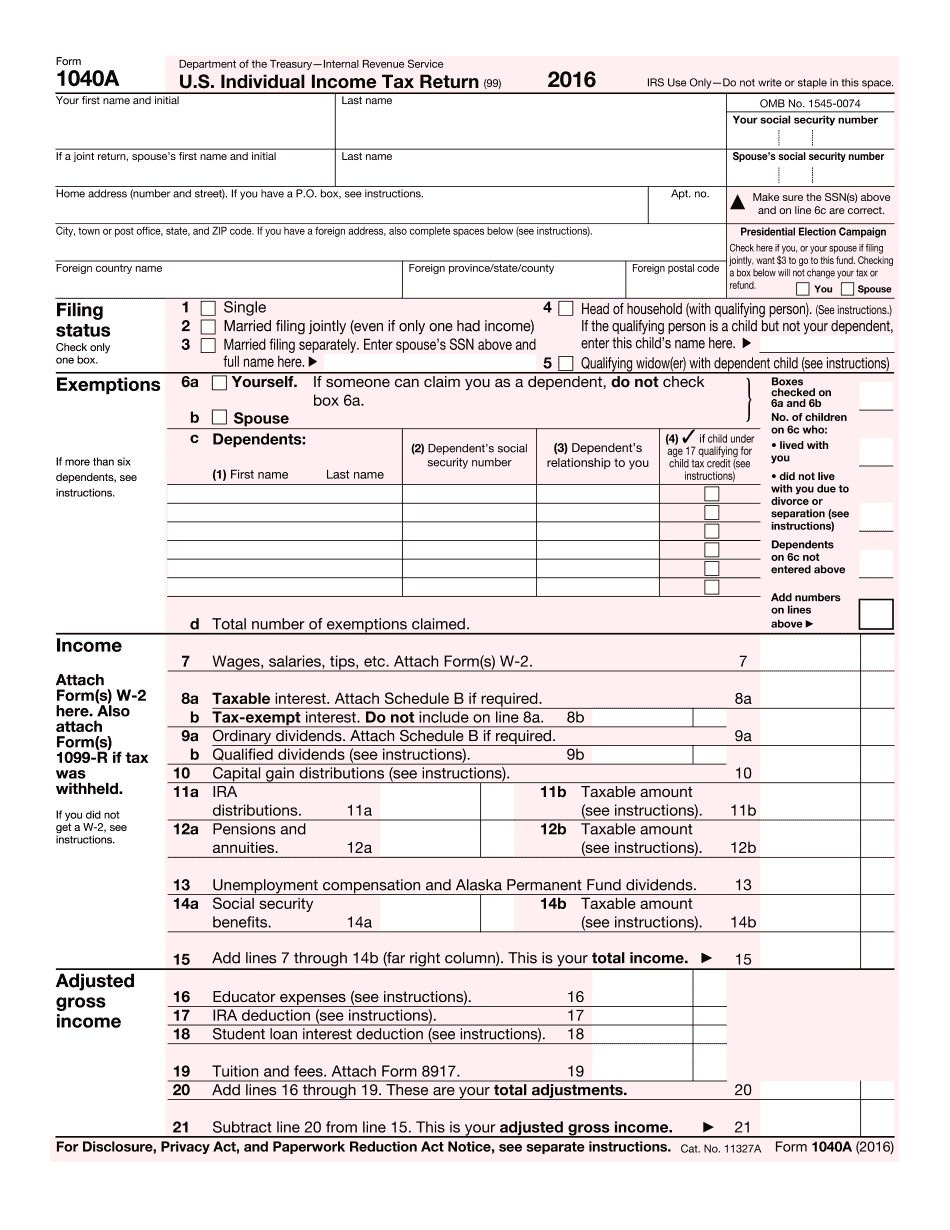

2022 IRS 1040-A online Riverside California: What You Should Know

Federal Tax Legislation Update Aug 23, 2025 — Learn about major tax legislation updates in 2017. Taxpayers who do not file an 2025 federal tax return, may be subject to income tax penalties and/or interest at their next annual tax deadline. Form 2848, U.S. Taxpayer Identification Number and Credit Card Use Rules — IRS Form 2947, Qualified Use of Savings Plan and IRA Rules — IRS Aug 23, 2025 — The IRS has removed information on the U.S. Department of the Treasury's Website that states that individuals using a credit card to pay the federal income tax may be subject to a credit offset of the credit limit on any future tax year. Qualified Retirement Plans for Employees Aug 22, 2025 — Learn about the latest changes in tax rules for qualified retirement plans for federal civilian employees. Contact a TAC or call to File for an Estimate for a Federal Tax Refund Aug 21, 2025 — Tags in California may be able to help you if one of these issues has arisen: I can't file my tax return. Help — IRS I received a duplicate or an invalid tax return. It must be a mistake — it is not a duplicate or invalid. What can I do? — IRS I did not know I was due a refund. Help — IRS Did you receive an unauthorized tax refund after April 17, 2017? Why is that? — IRS Tax-Free Period for Children — IRS. Aug 19, 2025 — The IRS has added a new form for filing for a tax-free period for Children for a limited period of time, and to receive an IRS tax refund or credit. Tax-Free Period for Dependents of Military Personnel — IRS Aug 17, 2025 — The IRS has added more information explaining tax-free period for military children and dependents of soldiers and their families. Tax-Free Period for the Disabled — IRS. Aug 17, 2025 — The IRS has added a form for filing for a tax-free period for nonmilitary dependent children. New Income Tax and Family Size Limitations — IRS Aug 17, 2025 — For the last two tax years the IRS has increased how much income taxpayers who are unmarried or have no dependents can earn before triggering penalties.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1040-A online Riverside California, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1040-A online Riverside California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1040-A online Riverside California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1040-A online Riverside California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.