Award-winning PDF software

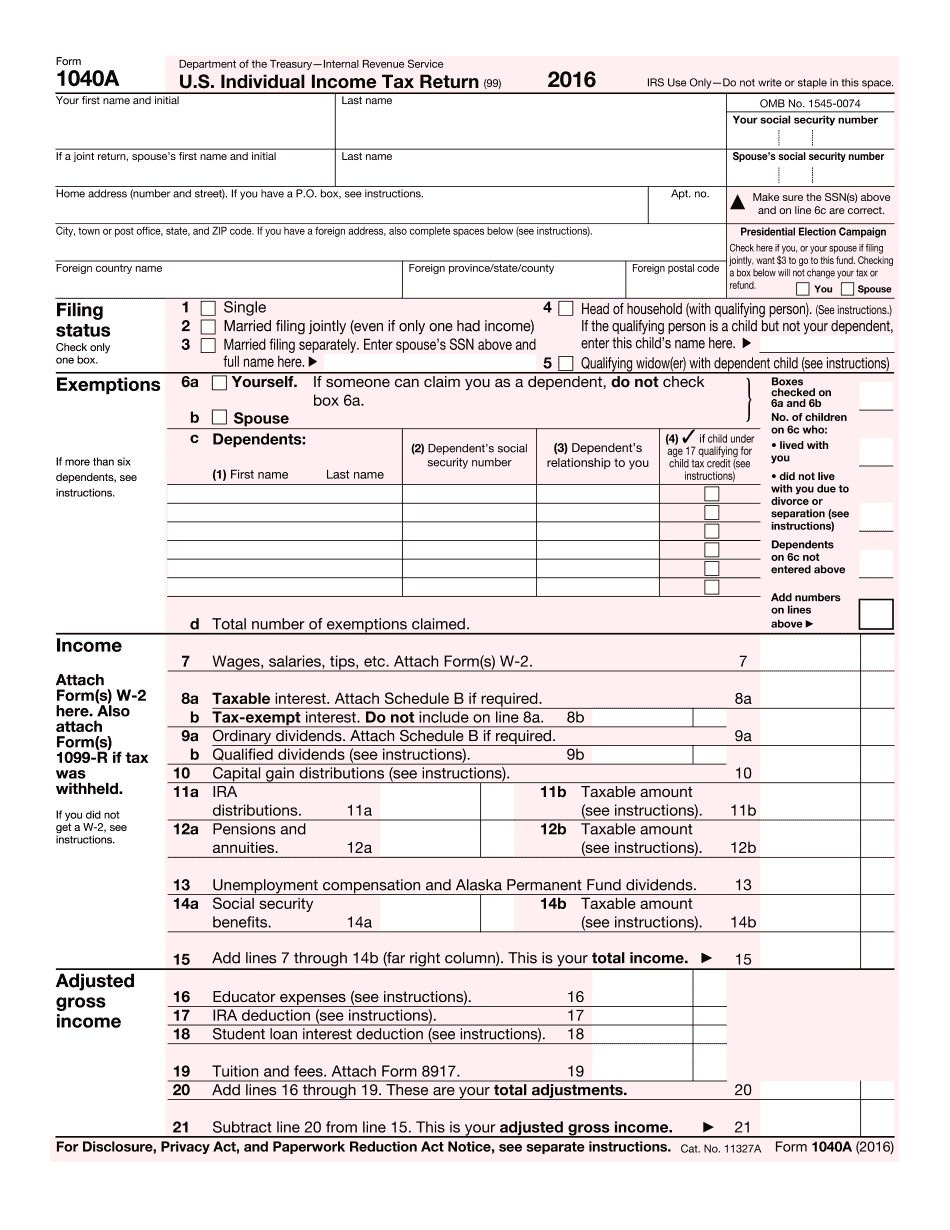

2022 IRS 1040-A Minnesota Hennepin: What You Should Know

You can do this by completing and mailing your Property Tax Refund Application. A Form 4453 is also required in 2018-19. This form allows us to track and keep track of sales of assets in the state including sales taxes, and sales within MN. For tax years 2017-18, we track sales of tax-exempt bonds and non-tax exempt certificates of participation for each resident. 2018-19 Property Taxes (PDF) Where's My Tax Refund? — Minnesota Department of Revenue May 29 – Aug 1, 2025 – We will deposit tax refunds into the following bank accounts and mail you your tax refund check. Your property tax refund check should be postmarked between May 29 and June 9. Property Tax Refund Mailing Address: P.O. Box 1353 Apple Valley, MN 55080 Filing for a Refund May 23, 2025 – We will deposit any refund that is not returned to us into a specific bank account within 15 days. Any refund that is not returned to us (due to your bank not receiving it), after the deadline, will be returned to you and your payment will remain the same. How To File a Refund — Minnesota Department of Revenue Filing for the Remission of Child Support Enforcement Burden May 26, 2025 — Form 5330.3.1-MN, Remission of Child Support Enforcement Burden can be used to show that you have reduced the amount of child support that was required to be provided by the court. After we electronically file your request, you may file it to either the Department of Workforce Development — Child Support Enforcement or in the county where the child resides. DEDUCED May 28 – Mar 31, 2025 – We will deposit payment for child support and the portion of a spousal support award that was ordered by the court that is not paid by the employer or the employer and a person on the child's financial support order (if available) into one of the following bank accounts: MNT — MN Taxpayer LED — LED State Tax Any amount left over after processing this application will require that you use the following forms to submit your payment: MNT — Minnesota Taxpayer LED — LED State Tax The application to receive these payments must be sent electronically. The Department of Revenue will retain the electronic file, so payments made under this form may be paid via Federal Express, MoneyGram prepaid and checks for the Department of Revenue.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1040-A Minnesota Hennepin, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1040-A Minnesota Hennepin?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1040-A Minnesota Hennepin aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1040-A Minnesota Hennepin from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.