Award-winning PDF software

2022 IRS 1040-A California San Bernardino: What You Should Know

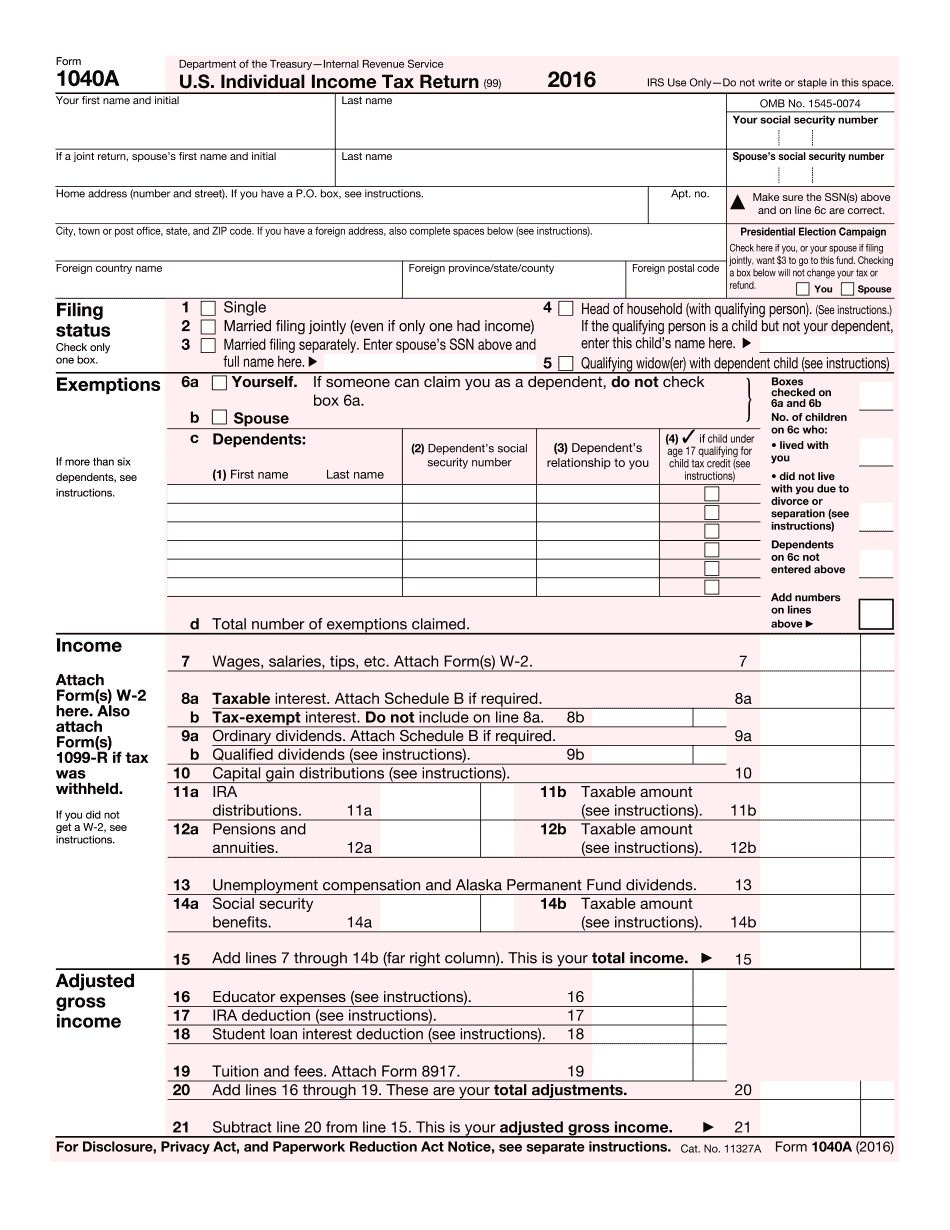

TAC scan help you solve your tax questions and apply for tax refunds. How To File Your Taxes | IRS.gov You are responsible for your individual, household, corporate, and estate income taxes. For more information about the federal income tax, please visit our tax law pages, including: Taxes you Pay to the IRS | U. S. Department of the Treasury How To Make A Tax Payment | IRS.gov Federal Income Tax Returns | IRS.gov For tax filing procedures, see: For general IRS information, go to our website. If you need to make an inquiry, fill in a tax-related online contact form, or call us at (voice) or (TTY). For additional information about tax matters or to obtain the services you need, visit IRS.gov. What is a W-2? | IRS What's the difference between the Federal Insurance Contributions Act and the Federal Unemployment Tax Act? The Federal Insurance Contributions Act is part of the Internal Revenue Code. It makes a Federal requirement to pay payroll tax contributions, based partly on an employee's salary. The Federal Unemployment Tax Act is separate from the general tax system. Under the Act, an employer may reduce the employee's monthly wage by a percentage. This payment is often referred to as an “employee penalty.” Tax law is complex, and a lawyer can help you learn about it. Tax Basics | IRS.gov, 2018 Do you need a guide in your language to help you file your taxes? Visit our Tax FAQ page to learn more Who is responsible for paying federal income taxes? You must pay federal income taxes to the IRS when you earn taxable income. See who is responsible for filing with the IRS about Form 1040, 1040A, 1040EZ, 1040A EZ, and 1040. What is income tax? The General Revenue Tax Act of 1986 (Act) established a tax structure for all businesses and institutions throughout the United States. It provides revenue for the U.S. Treasury by taxing the net profit of all businesses and institutions. Under the Act, income is defined and taxed when earned. All individuals, partnerships, limited liability companies (LLC) and S corporations were required to file a tax return even if they were making a loss.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1040-A California San Bernardino, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1040-A California San Bernardino?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1040-A California San Bernardino aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1040-A California San Bernardino from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.