Award-winning PDF software

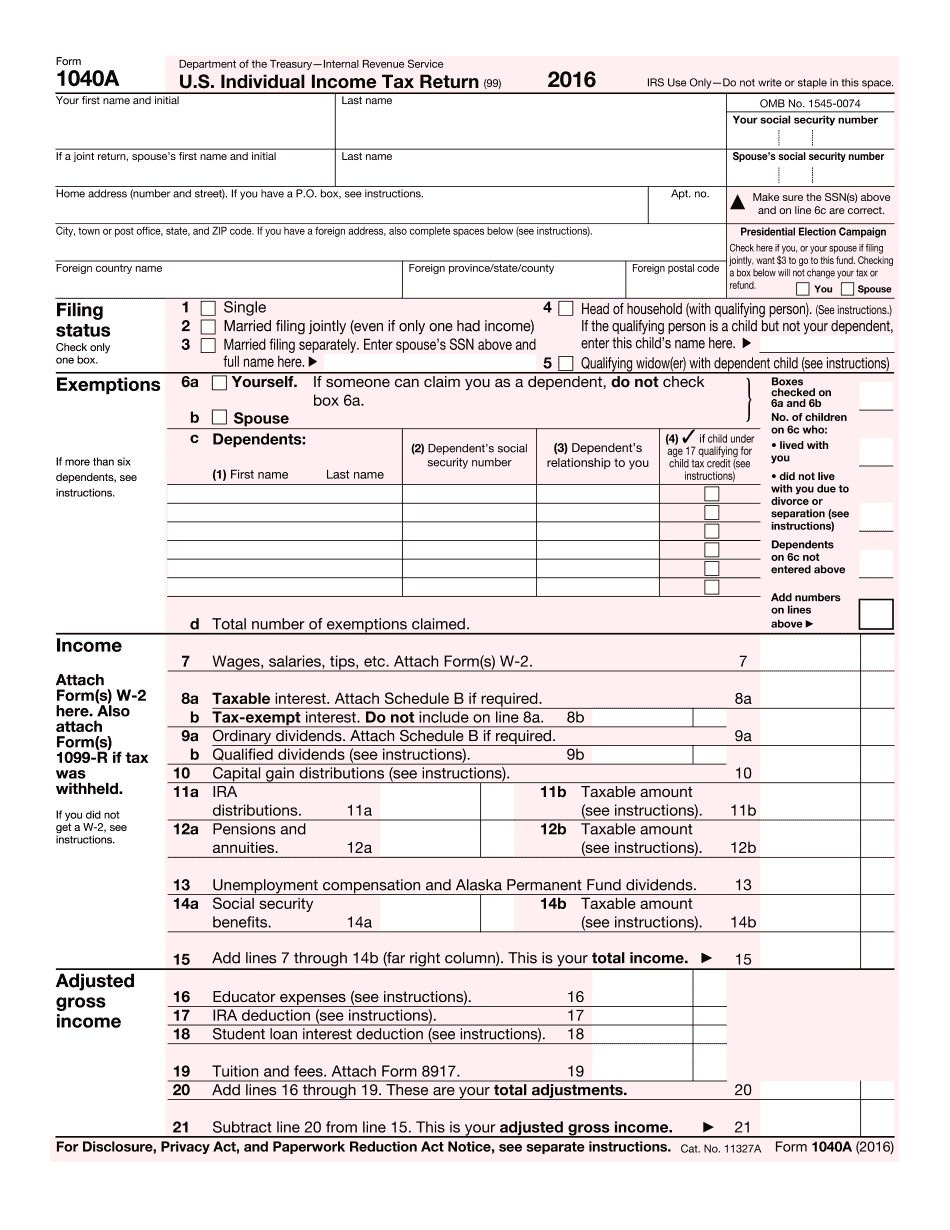

Printable 2025 IRS 1040-A Wichita Falls Texas: What You Should Know

Form 4029, Retirement Income Credit. If you are 65 or older, or have not reached age 65 as of the end of the tax year for which filing requirements are imposed by subsection (i) of section 6733 of the Internal Revenue Code, then you may be eligible for the retirement income credit provided by section 56(h)(6) of the Internal Revenue Code. About Form 4868, Social Security Disability Insurance and Supplemental Security Income — IRS Use Form 4868 to figure the Social Security disability insurance and Supplemental Security income (SDI) benefits, or SSI benefits if the individual is disabled (by physical or mental impairment) as described in section 208(a) of the Social Security Act. Form 4868 should be used when the individual qualifies to receive benefits from either the SDI program or the SSI program under Section 8 of the Social Security Act (42 U.S.C. 402(8)). Use Form 4868 to figure the SSI or SDI premium payment if the individual qualifies for the premium payment from an SSI program or if the individual's filing status is an SDI program resident. Contact Us — IRS You can reach IRS to learn more about Form 8868, Social Security Disability Insurance and Supplemental Security Income (SDI) payments. Contact Us — Social Security Administration You can contact Social Security Administration to learn more about how SSI, SDI program benefits are paid. Tax-Exempt Organizations — IRS Your organization can contact IRS to inquire about your organization's position concerning the tax treatment of a particular charitable contribution. Find Out Ways to Reach IRS by Email We can reach IRS by email at or call for non-recorded or TDD inquiries. We encourage you to use email to reach us. What Types of Taxpayer-Provided Funds Can Be Used to Pay for Certain Education Costs — IRS You may use certain tax-exempt funds to pay for certain educational costs, even though those costs are not reimbursed by the government. For example, you may not use tax-exempt funds to reimburse you for professional fees if the fees are for your professional services for other people. See the section titled “Use of Tax-Exempt Funds for Education Costs,” later.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable 2025 1040-A Wichita Falls Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable 2025 1040-A Wichita Falls Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable 2025 1040-A Wichita Falls Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable 2025 1040-A Wichita Falls Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.