Award-winning PDF software

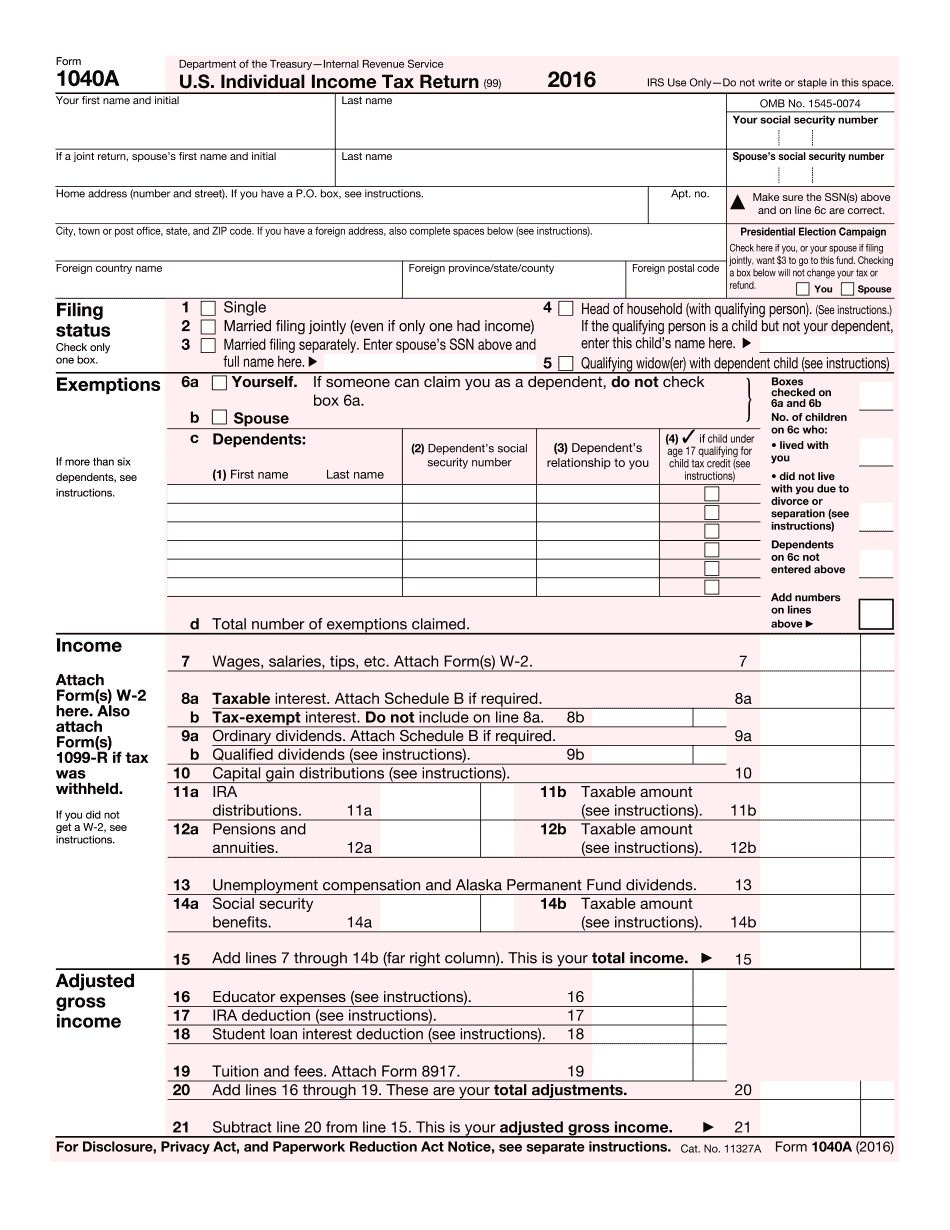

Chicago Illinois 2025 IRS 1040-A: What You Should Know

Illinois — Where to File Addresses for Taxpayers and Tax — IRS These Where to File addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns to Illinois during Calendar Year 2022 Illinois — Where to File Addresses for Taxpayers and Tax — IRS These and other useful information are available on IRS.gov Apr 30, 2022- Tax Credit Extension for Individuals in the Illinois Credit Opportunity Program (Coop) Tax Credit Extension for Individuals in the Illinois Credit Opportunity Program (Coop) was announced by the Secretary of the United States Department of Education (US DOE) today. Apr 30, 2022- Tax Credit Extension for Individuals in the Illinois Credit Opportunity Program (Coop) Tax Credit Extension for Individuals in the Illinois Credit Opportunity Program (Coop) was announced by the Secretary of the United States Department of Education (US DOE) today. The law extends the credit for an additional year beginning July 6, 2022, through June 30, 2023. Effective January 1, 2023, individuals whose income was in excess of their credits will no longer receive a tax credit at a rate of 0 for the 2025 tax year. Mar 30, 2022- Effective Date for Employer Health Insurance Cost Containment Provisions The federal regulation implementing Section 5000A of the Health Insurance Portability and Accountability Act of 1996 went into effect on March 16, 2022. This means employers who offer qualified health benefits to covered employees (including self-only coverage) must notify covered employees of the option to exchange employer-provided health insurance for qualified health benefits, with the option of offering employer-provided benefits directly to covered employees when the employee requests them. Mar 10, 2022- Illinois Small Business Tax Credit Extension for Individuals Tax Credit Extension for Individuals was announced by the Secretary of State's Office of Small Business Services on November 20, 2017. The extension does not apply to small business owners who have a qualified health plan through the Illinois Medicaid program. Oct 31, 2025 Illinois Health Care Financing Corporation (HFC) Annual Report Illinois Health Financing Corporation (HFC) Annual Report is available for Illinois residents today. The Annual Report contains information on the organization's operations, financial status, investments, and recent business activities. Read more on Illinois HFC Oct 24, 2025 Illinois DOL Notice to Employer Notice (No. -1) is required by Section 16(1) of IAS 6300.1 (Illinois Business Corporation Act).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Chicago Illinois 2025 1040-A, keep away from glitches and furnish it inside a timely method:

How to complete a Chicago Illinois 2025 1040-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Chicago Illinois 2025 1040-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Chicago Illinois 2025 1040-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.