Award-winning PDF software

2022 IRS 1040-A online Costa Mesa California: What You Should Know

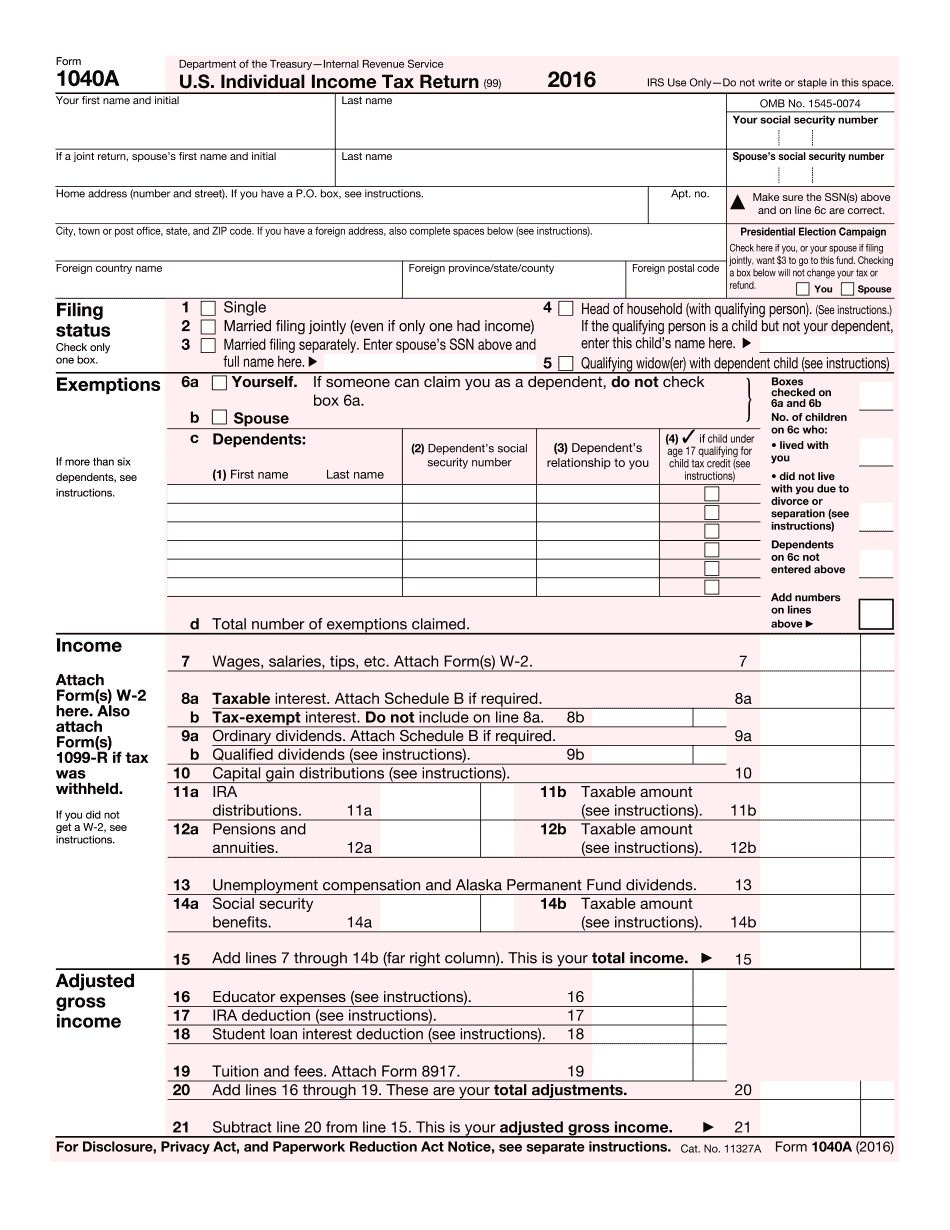

IRS Form 1040-X, Amended U.S. Individual Income Tax Return to: 1. File amended income tax return 2. Correct a previously received Form 1040, Form 1040-SR, Form 1040-A, Form 1040-EZ, Form 1040-NR, Form 4210, or Form 4684 or an individual tax return Topic No. 310 Tax Payment Plans | Internal Revenue Service If you're a resident of one of the 50 states, the District of Columbia, or U.S. territories, you're not limited to paying only federal tax. You may also choose to pay some or all of your federal income tax liability (which you can do until age 65 or older) with a valid tax refund and/or a tax deferral for certain years. You can use the Internal Revenue Service (IRS) Topic No. 290 Income and Exemptions | IRS Whether you're single or married filing jointly, there are many income and income tax rules that apply to you, so find out how much you can deduct. Also, the federal tax and how your states and localities administer it are very different. Find out information you need to figure out how much you're allowed to have as an investment and then take full advantage of those gains. Topic No. 284 Transportation Expenses and Excise Taxes | Federal Excise Tax How much you pay for transportation fees and sales taxes is your tax liability. If the purchase (or sale) meets certain conditions, you'll be able to deduct expenses from your taxable income — without itemizing deductions like mortgage interest, charitable contributions, or state and local government income tax. See more about transportation expenses Topic No. 273 Gross Income and Taxable Contribution Limit | Federal Income Tax The federal income tax limits on taxable income and taxable compensation is modified by deductions and credits, some of which you can take before you file to offset your income from certain sources. The federal tax on your income will remain the same no matter which plan you choose. The only way to minimize your tax liability is to reduce your taxable income to the extent possible. Topic No.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1040-A online Costa Mesa California, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1040-A online Costa Mesa California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1040-A online Costa Mesa California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1040-A online Costa Mesa California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.