Award-winning PDF software

2022 IRS 1040-A for Allentown Pennsylvania: What You Should Know

The National Taxpayer Advocate for the Elderly, in partnership with the U.S. Department of Housing and Urban Development, is a 24-hour, emergency service to assist citizens over age 60 with issues with their housing and housing-related programs. Visit IRS.gov or call for more information. What's New in the August 2025 Issue The June 2025 issue, also known as the October issue, was the most anticipated issue for many years. Some highlights included, a complete guide to the tax year 2019, advice for preparing an estate for tax purposes, the IRS guidance on tax-qualified health insurance (T-boned tax returns), tax-deferred retirement planning and more. For more information, download a free copy of the June 2025 issue of Tax Counseling for Your Millennial, your go-to publication for help at your millennial's next step. For a full-page ad featuring your young person's tax return, visit the 2025 Teen Tax Credit page. A Tax Counseling for Your Millennial article written for our own young person. More recent articles featured in 2025 include, our “Tax-Calculation for Your Millennial” post on April 26 and our “Your Tax-Free Student Loan Refund” post which was published on the 17th. Visit TaxCounseling.com, click on our website, and you can get an instant Tax Counseling for Your Millennial subscription free of charge! No credit card is required. The publication of Tax Counseling for Your Millennial has been discontinued and all content is now available via the website's mobile apps. We are very appreciative for the many readerships that we have enjoyed. Your comments, as always, are valued and cherished. Follow us on Twitter tax counseling and TOC_Millenial Get Connected to Your Millennial For questions about the Tax Counseling for Your Millennial program, your next step, or how to get professional tax help, visit us on Twitter and Facebook and send us a message online. Subscribe for the latest free tax news, information and tips. Email Address Newsletter Sign up for free tax e-newsletter Our newsletters are for you. We won't share or sell your information.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1040-A for Allentown Pennsylvania, keep away from glitches and furnish it inside a timely method:

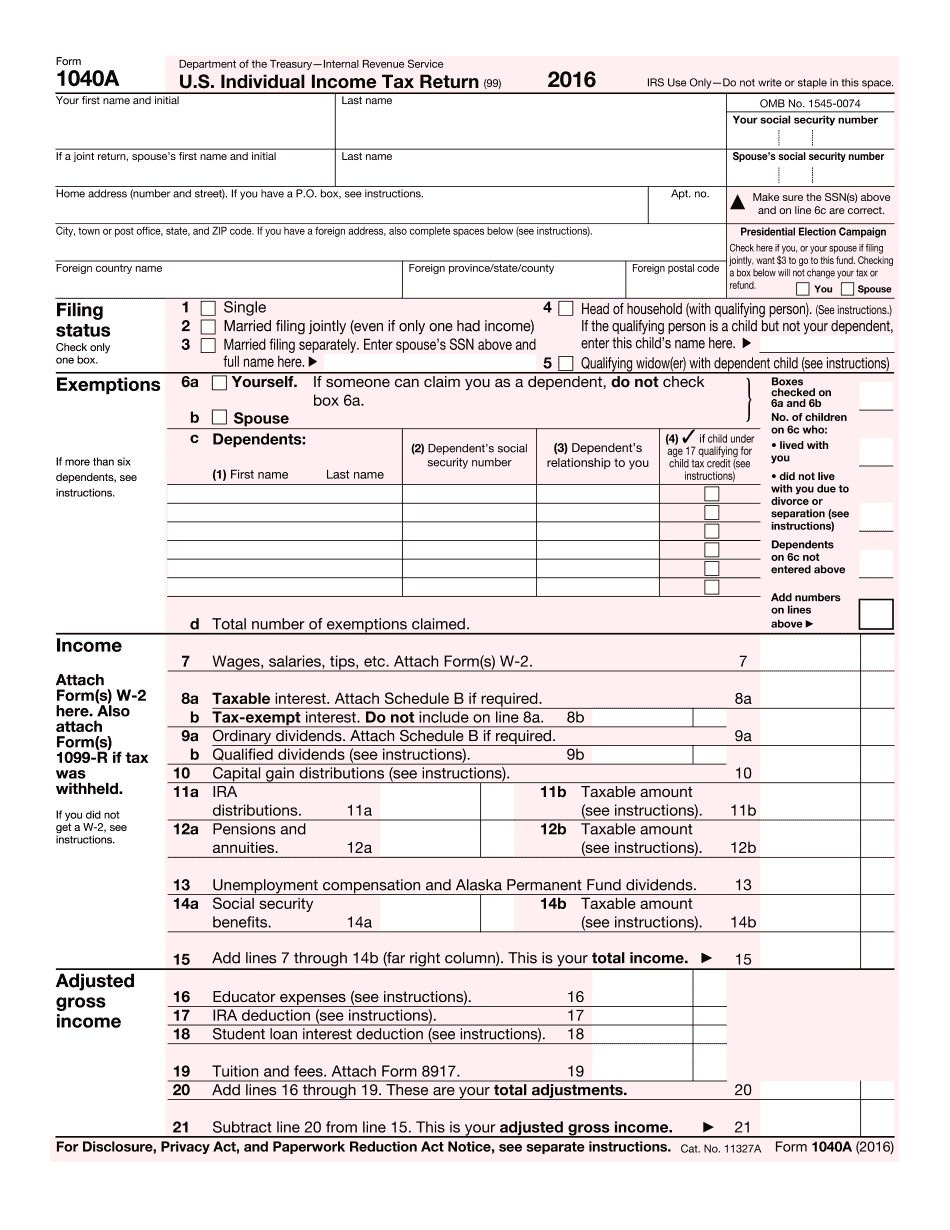

How to complete a 2025 1040-A for Allentown Pennsylvania?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1040-A for Allentown Pennsylvania aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1040-A for Allentown Pennsylvania from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.