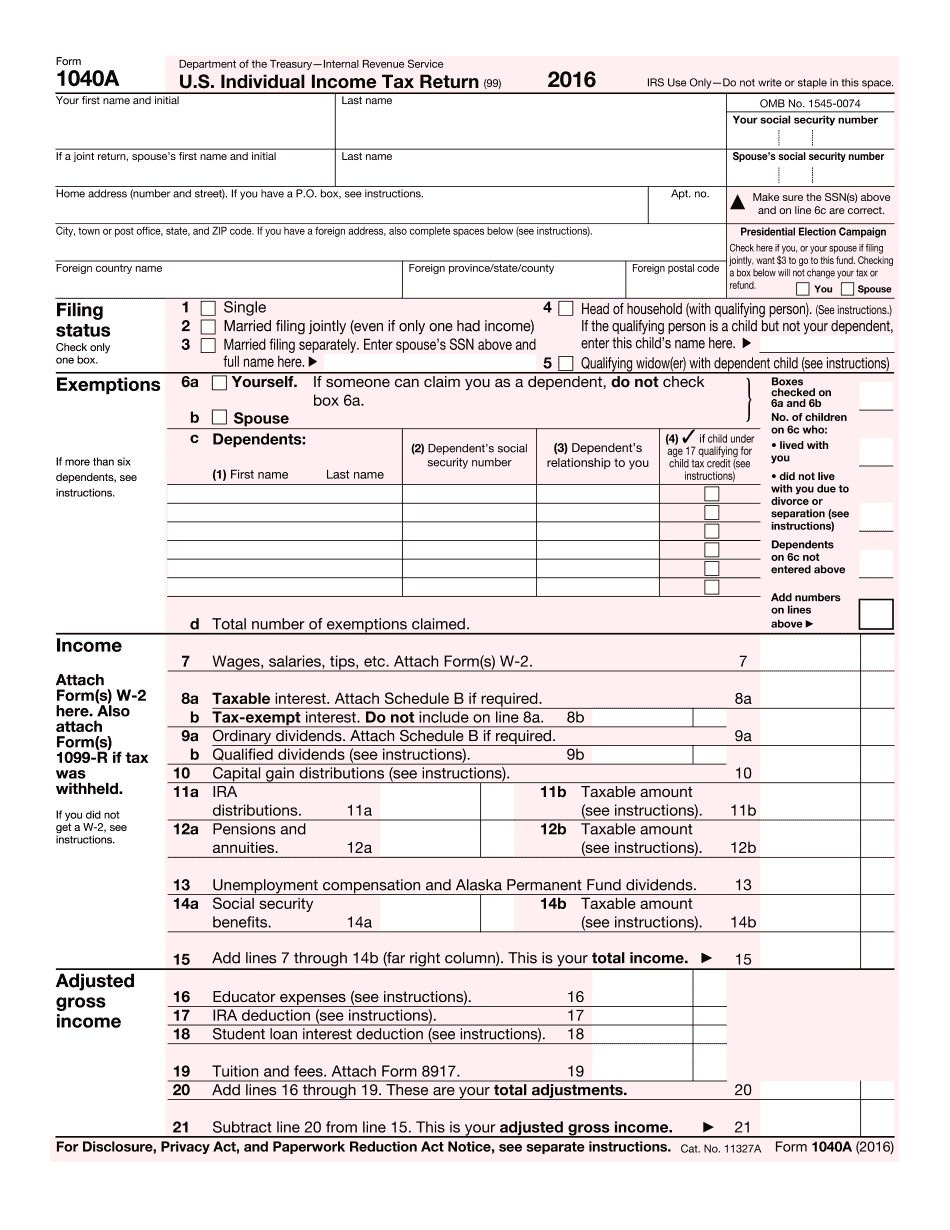

2016 IRS 1040-A and Form 1040: Basics

How Do IRS Forms 1040-EZ, 1040-A and 1040 Differ?

For a business employee, you filed a business-owner's individual return. This can be a little tricky with the recently changed rules for employer-sponsored health insurance. If a business has a health plan (either an employee group plan or a plan you choose for your employees as an employer) your employee won't need to file Form 1040-EZ. The IRS will determine whether your business has a plan that applies to your employees and will send you a Notice of Assessment asking you to answer questions. You should have no difficulty answering all the questions provided to you. This is the only form you need to obtain to satisfy the health coverage rules. Form 1040-A (Form 1040-A-EIN): This is the individual-group form you filed as an individual. For a person other than a business owner, you filed Form 1040-A (Form 1040-A-EIN or 1040-EZ). The Form 1040-A-EIN is used to report business income and losses. You must obtain Form 1040-A-EIN from your employer each time you have paid wages exceeding 200. You must also provide a copy of your W-2 form for each year of the payment amount. The Form 1040-A-EIN is issued for each pay period that meets the requirements listed below for reporting certain business income. If your business fails because of a natural disaster, a war, civil unrest, quarantine, or attack of foreign nations, or any other similar emergency, your business income is not subject to reporting or withholding. For these situations, you can file Form 1040-A-ES for business income. If you are self-employed, you will generally file Form 1040-EZ for business income and losses. Form 1040-A-ES cannot be used to report business income or losses for small businesses. Business Income or Loss Exception. When a business's net income exceeds its expenses, it is generally considered an operating surplus. It is then generally a tax-exempt source of income. If your business can demonstrate it earns enough income to be an operating surplus on your returns for the year, but the business can't show it actually collected more earnings than expenses, you may be able to reduce your income tax

Form 1040: U.S. Individual Tax Return Definition, Types, and Use

A “tax return,” then, must be submitted to the IRS by an individual filing taxes for the year. This form is sent to the IRS by a taxpayer during the taxpayer's monthly tax response period, which is the time from the due date of filing the return to the payment of all the taxes due. The IRS uses its own rules when it determines which taxpayers fall within the monthly tax response period. Forms for Forms 1040 (Tax Returns) and 1040NR Use Form 1040, which can be mailed to the IRS or mailed to the address on the form. Form 1040 (Tax Returns) or Form 1040NR (NR1040NR) Form 1040, or Form 1040NR, can be sent to a tax processing facility in one of the following ways: The taxpayer can mail both forms directly to the IRS. Mail the form with an itemized statement of income and expenses to the address on the form. (See U.S. Filing Tips at page 7 for information on mailing the form in person.) Mail the form with an itemization statement of income and expenses to the address on the form. The taxpayer also can mail the form electronically to the address on the form using the IRS' Secure Access for E-File Users (SAFE) service. . The IRS can mail both forms directly to the taxpayer. Mail the form with an itemized statement of income and expenses to the address on the form. The taxpayer also can mail the form electronically to the address on the form within 3 or 45 days of the taxpayer's filing due date. To help taxpayers with complicated transactions, or who have questions about mailers for electronic filing, ask them about the Electronic Data Retrieval Service (EARS) (Form W-6). Forms for Forms 1120, 1040A and 1040NR Use Form 1120, which can be mailed to the IRS or mailed to the address on the form. Form 1120 (Tax Forms) In some cases, taxpayers may still want to complete one form for both the 1040 and the 1120 form that the taxpayers filed using a different address on the 1040. Form 1120 should not be used only if the taxpayer did not use a different address on the 1040 and the 1120 forms. When filing the 1040 and 1120 together, send both forms as a single PDF, not one single

Award-winning PDF software